IFHRMS Pay Slip 2024. ifhrms salary bill. Check the list of ifhrms salary bills at karuvoolam.tn.gov.in. Download the 2024 IFHRMS Pay Slip Beneficiaries List PDF. Download Tamilnadu 2024 PDF Password for ifhrms Pay Slip. Pay Drawn Particulars. Download the GPF Account Slip in Tamil.

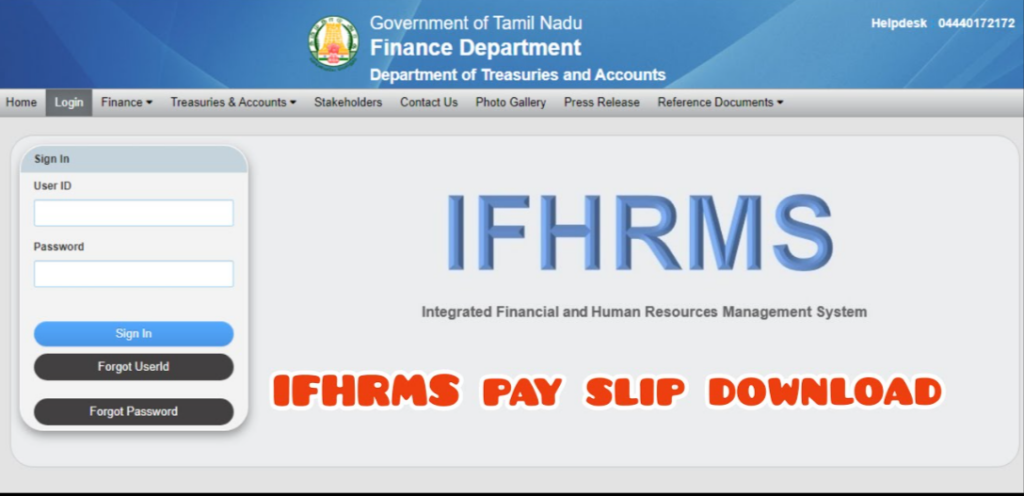

Examine the IFHRMS Pay Slip 2024 PDF Download and register on this website. Employer Salary Slip 2024 Login and Online Registration. All candidates who have expressed interest in this program may do so online at karuvoolam.tn.gov.in, the official website. IFHRMS Login.

IFHRMS Pay Slip 2024

The Tamil Nadu government launched the IFHRMS online portal. On this service, retirees and government workers can view their monthly slips. Information about employees, including bank account details and pension amount, can be found on this platform. Its goal is to support employees in the finance department. This portal provides access to real-time budget details, payroll, leave management, and more. This is where staff members can file complaints about the government. Candidates who are interested may apply online via the official website.

IFHRMS PAY SLIP DETAILS

| Name | Finance and Human Resource management |

| Authority | Government of Tamil Nadu |

| Department | Finance and Human Resource management |

| Category | Pay Slip |

| State | Tamil Nadu |

| Helpline Number | 048440172172 |

| Official Website | karuvoolam.tn.gov.in |

REQUIRED DOCUMENTS FOR IFHRMS Gpf Account SLIP 2024:

- PAN Card

- Aadhar Card

- Residential Proof

- ID Proof

- Passport Size Photo

STEPS TO DOWNLOAD IFHRMS GPF Account SLIP:

- Go to official website through @ karuvoolam.tn.gov.in

- Then select employee type.

- Fill in all required details such as username and password.

- Then click on sign-in button.

- Now go to Finance option on next page.

- You will be redirected to a new page and select payroll option.

- Now your payroll page will generate and download your pay slip 2023.

ELIGIBILITY CRITERIA IFHRMS

- Employees must be a citizen of Tamil Nadu.

- A government job must employ applicant.